Send this article to a friend:

February

11

2026

Send this article to a friend: February |

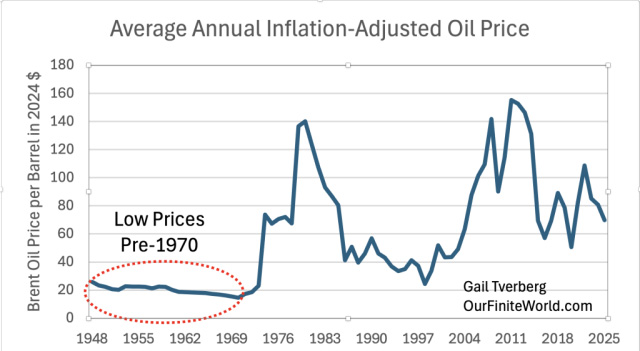

Economic Models Are Overlooking a Looming Diesel Crisis

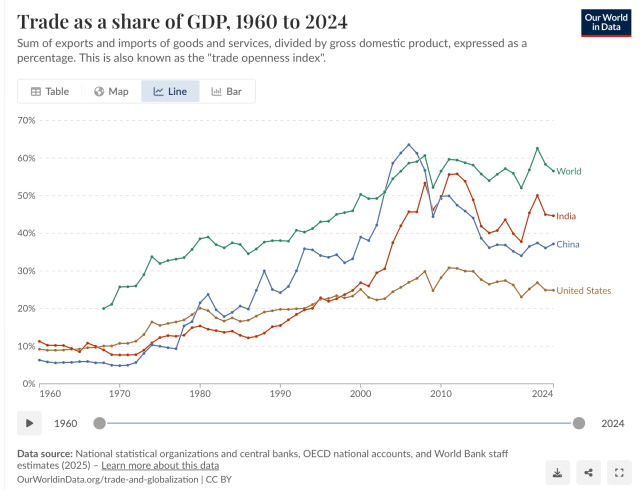

I believe that there is an underlying problem that most people are missing. A worldwide shortage of diesel and jet fuel is forcing international trade to begin moving into a new downward phase, relative to the recent share of GDP shown on Figure 1.  Figure 1. Trade as a share of GDP, 1960 to 2024, in a chart prepared by OurWorldinData.org. While international trade grew as a percentage of GDP between the 1960s and 2008, it has been basically flat since then. Now the shortages of diesel and jet fuel are forcing the international trade percentage to start falling to a lower level. In this post, I will try to explain the situation further. One conclusion: Conflict results from the need to reorganize the world economy in a way that uses less long-distance international trade. [1] Background: The world economy is a dissipative structure, operating under the laws of physics. The economy behaves differently than most researchers assume because economies are dissipative structures, operating under the laws of physics. Most researchers model tiny parts of economies, and because their views are so narrow, they reach misleading or wrong conclusions. Most structures that we see, such as books or houses, are, in a sense, dead. Dissipative structures, however, are different in that they can temporarily grow. In order to stay away from being in a dead state, they need to “dissipate” energy of the proper kinds, in adequate amounts. Examples of dissipative structures include plants and animals of all kinds, ecosystems, and hurricanes. The human body is a dissipative structure that requires food to stay away from a dead state. Hurricanes are dissipative structures that dissipate the heat of a warm body of water. If an ecosystem doesn’t get enough energy of the right kinds, it will adapt to accommodate the actual mix of fuels and other resources available. If an ecosystem doesn’t get enough sunlight, or enough warm temperatures, or enough water, it will gradually shift toward a different mix of plants and animals that can operate within the mix of resources available. This is similar to what happens within the human body. If a human doesn’t get enough food, their body will shrink or become thinner. I believe that without adequate diesel and jet fuel, our economy will make a transition analogous to a human going on a diet, or analogous to an ecosystem changing when a different mix of resources is available. Academic researchers around the world have misunderstood how the process works because they tend to work in ivory towers. They create models based on the narrow view of the economy that their academic area considers appropriate. Once they have developed a narrow model, they cling to it, even though recent insights from physics suggest that a very different model is more appropriate. [2] Researchers in academic settings make many unwarranted simplifications in their models.Researchers like to assume that all energy is alike. Substitution is assumed to be relatively easy and quick. Models tend to indicate that if the supply of energy is inadequate, prices will rise. With these higher prices, the economic system will keep problems away practically indefinitely. The real world doesn’t work this way. When we eat food, we cannot simply substitute kale for all our other food consumption and expect to thrive, even though models would seem to suggest that kale is good for us. Within ecosystems, it is the mix of resources and predators that matters. If the top-level predator is killed off, the system will change. The world economy will face similar changes if today’s international transport system runs into difficulties. [3] The fuels especially used for international transport today are diesel and jet fuel. To be useful in international transport, fuels need to

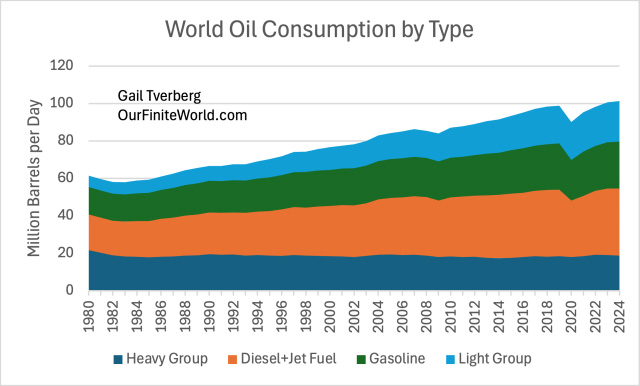

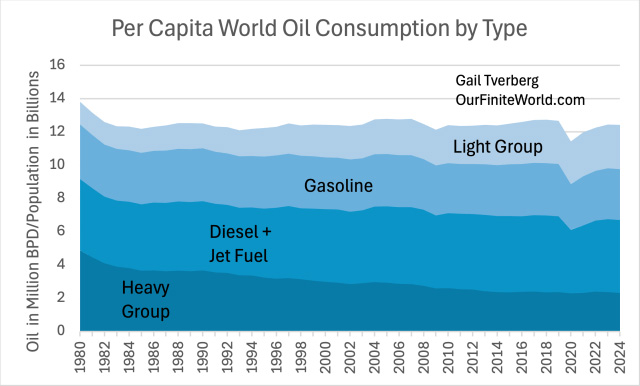

Diesel and jet fuel have long been the prime fuels used for international travel and transport. “Bunker fuel,” which tends to be heavier and more polluting, has also been used. Its use is strongly discouraged today because of pollution issues. [4] An issue we have today is that diesel is also essential for many other uses.Diesel is an essential fuel today for food production and local transport. Most of the agricultural equipment now in use operates using diesel fuel. Diesel-powered machines can easily navigate muddy fields. In addition, diesel also powers most of the heavy semi-trucks around the world. These trucks deliver goods of all kinds, locally, including food. Another essential use for diesel is building and maintaining infrastructure. This would include:

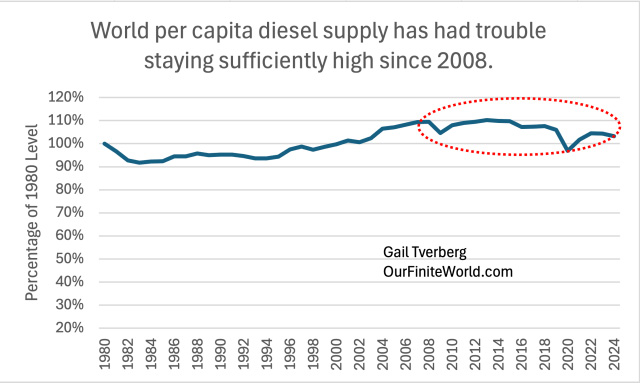

The importance of diesel to the economy is difficult for most people to see because these are behind-the-scenes types of activities. [5] It is very difficult to get the price of diesel to rise for any extended period. If the price of diesel rises, the price of food tends to rise. This happens because diesel is heavily used in food production and transport. Needless to say, high food prices tend to be unpopular with voters. For this reason, even if the diesel supply is low, the price of the fuel doesn’t necessarily rise. If this happened, voters would be very unhappy. They would elect new politicians. What, in fact, tends to happen is that oil prices (not just diesel and jet fuel prices) tend to bounce up and down. Figure 2 shows a chart of average annual oil prices.  Figure 2. Average annual Brent equivalent oil prices, in 2024 US$. Data for 1948 through 2024 from the 2025 Statistical Review of World Energy, published by the Energy Institute. Data for 2024 estimated based on EIA estimates of spot Brent prices for 2025, adjusted for inflation. Figure 2 smooths out some of the price irregularities. For example, there was a very high peak in July 2008, but the price fell to a low level by December of the same year. The peak doesn’t appear very high on this chart, but it greatly affected financial markets. See my article, Oil Supply Limits and the Continuing Financial Crisis. [6] Diesel and jet fuel disproportionately come from oil that is quite “heavy.” Oil refineries tend to offer lower prices for heavy oil, making it unattractive to extract.There is a price compression problem with heavy oil:

Because of these issues, the prices refineries are willing to pay for heavy oil tend to be lower than the prices they offer for “light, sweet” oil. For example, the current oil prices shown on OilPrice.com are $70.51 for Brent Crude (a light, sweet European crude), $65.13 for West Texas Intermediate (a sweet US crude) and $50.86 for Western Canadian Select, from Canada’s Oil Sands. Russia also has moderately heavy oil; Russia’s Urals blend is diluted to make it flow adequately. Its price is listed at $54.48. These pricing issues make the extraction of heavy oil, especially very heavy oil, unattractive to oil companies. Basically, oil prices do not rise high enough, for long enough, to make extraction profitable. People who look at the Energy Return on Energy Invested (EROEI) of resource extraction would say that the EROEI is very low. In other words, a huge amount of energy needs to be invested to make heavy oil extraction possible. This tends to make the cost of oil extraction expensive. Because of this price compression, and thus the low prices paid to oil producers, it is not very profitable for oil companies to extract heavy oil. This means that governments cannot charge these companies very high taxes, or they will stop producing oil completely. In addition, tax revenue collected from oil producers tends to fall too low to provide adequate government services., and it also becomes difficult to pay workers adequate wages. These issues lead to unrest in countries with heavy oil reserves, but not much other industry, such as Venezuela. [7] A naive look at the oil data received from the various agencies does not disclose the nature of the world’s oil problem. A chart summarizing the consumption of different types of oil, based on data from the 2025 Statistical Review of World Energy, is as shown in Figure 3. Note that the Diesel+Jet Fuel layer is the product grouping with the largest consumption. In the US, we hear a lot about Gasoline, but Diesel+Jet Fuel is the layer with the greatest fuel consumption. Diesel+Jet Fuel provides a huge quantity of services, but its usage is mostly hidden from sight.  Figure 3. Figure prepared using data from the “Oil-Regional Consumption” tab of the 2025 Statistical Review of World Energy, published by the Energy Institute. The Light Group is the combination of naphtha, ethane, and liquid petroleum gas (LPG). These are close to gases. The other categories have longer molecules, and thus higher boiling points. The Heavy Group includes waxes, lubricants, asphalt, as well as a fairly unrefined oil, used as a cheap but polluting fuel, shown as “Fuel Oil” on the same tab. Most published data show only the sum of the four layers in Figure 3. It seems to be rising. This amount represents a combination of quite a few types of oil. When this increasing production is considered along with the reported high oil reserves (particularly heavy oil in Canada and Venezuela), and the belief that prices will always rise if there is a shortage, most researchers cannot imagine that a problem might be occurring. Researchers often overlook how crucial oil is to the economy. People all over the world need food, roads, and many other things that depend on oil. The number of people who can make an adequate living seems to depend upon the oil supply. It makes sense to look at oil supply per capita. The chart below uses the same amounts, divided by world population. On this basis, world oil consumption is flatter. In fact, per capita oil supply has been somewhat declining recently.  Figure 4. Amounts shown in Figure 3, divided by world population used by the Energy Institute in its 2025 Statistical Review of World Energy. Different colors are used in this chart compared to Figure 3. The other thing that becomes apparent from this chart is that the overall mix of products coming out of current processes (extracting and refining oil) has been getting lighter over time. This should not be surprising because the most rapidly growing oil supply since 2008 has been tight oil, extracted from shale in the United States. This tight oil tends to be quite light, adding output to the Light Group and to Gasoline, far more than to Diesel+Jet Fuel or the Heavy Group. [8] The pattern of diesel supply growth provides insight into what is going wrong with world trade. Figure 5. World per capita diesel supply based on data of the 2025 Statistical Review of World Energy, published by the Energy Institute. Diesel is about 78% of the combined grouping Diesel+Jet Fuel. The two are similar enough that refineries can slightly change the output mix between the two. The World Trade Organization began operation in 1995. Its purpose was to encourage more world trade. The Kyoto Protocol of 1997 encouraged countries to cut their own CO2 emissions. The easiest way to do this was by sending manufacturing, mining, and other industries to other countries around the world. Thus, indirectly, the Kyoto Protocol also encouraged world trade. Figure 5 shows that between 1995 and 2008, per-capita world diesel consumption was increasing. The restriction in supply that began around 2008 corresponds with the flattening of world international trade shown in Figure 1. [9] Several issues contributed to the drop in per-capita diesel supply starting about 2008.

[10] The world order seems to on the verge of radical change. We are now facing a situation in which the world economic order seems to be breaking apart, in order to form a new order that “works” better with the changing quantity of Diesel+Jet Fuel available. We are dealing with a situation that has much in common with a game of musical chairs.  Figure 6. Chairs arranged for Musical Chairs Source: Fund Raising Auctioneer The game of musical chairs is played in rounds. At the beginning, there are as many players as chairs. In each round, one of the chairs is removed. The players walk around the circle of chairs until the music stops. When the music stops, all the players try to grab a chair to sit on. There can be small fights over who gets a chair. The person who does not get a chair is eliminated from the game. When an economy is faced with an inadequate supply of Diesel+Jet Fuel, it needs to regroup in a different way. To do this, some existing businesses and governments must fail, so that others can take their place. In addition, supply lines need to be rearranged to use the resources that are actually available. Customs and beliefs may need to change, as well. The way nations interact can change as well. In the years of growing international trade, (1970s to 2008), co-operation seemed to be important. Working together was relatively easy. During the tearing down stage, which seems to be starting now, the situation can be expected to be very different. We can expect assertive leaders, and lots of conflict. We are facing this strained situation today. [11] What lies ahead? I don’t think that any of us know for certain what will happen in the future. Nevertheless, the self-organizing world economy seems to be organizing for itself what is ahead. Or perhaps, the hand of a Higher Power is organizing what is happening. I have only discussed the problem of inadequate Diesel+Jet Fuel, and its impact on international trade and some other parts of the economy. There are other shortages that the world economy needs to work around, that I have not touched on: In many parts of the world, one shortage is of fresh water. This is often connected with depleted aquifers and today’s high human population. Another shortage relates to the critical minerals required for a high-tech society. Billionaire Robert Friedland describes the issue in this video. We have plunged headlong into high tech goods of all kinds, including wind turbines, solar panels, electric vehicles, batteries, computers, and electrification of many kinds of things without realizing that we would soon reach limits in the supply of many minerals used in making these high-tech devices. For many of these minerals, China controls the vast majority of these critical minerals. Countries must try to start producing their own critical minerals, or remain on good enough terms with China to purchase some of the limited supplies available. A third shortage relates to nuclear, and our plans to ramp up nuclear energy. As far as I can see, uranium extraction is currently constrained. In theory, it can be ramped up, but it takes a long chain of events to do so. With these shortages, AI seems to be constrained in how quickly its use can be expanded. It needs to become far more energy efficient to be truly useful. With all of these issues, it seems impossible to keep forging ahead as we have done in the recent past. We are being forced to source more of our manufactured output locally. We need to greatly reduce the transportation of goods across the Atlantic and Pacific. Using tariffs seems to be a way of trying to accomplish this change. Strange as it may seem, some of Trump’s policies make a certain amount of sense, when viewed in the light of the issues the world is facing. I expect that a replacement leader would be just as abrasive. The new leader would likely have different strange policies, but the underlying problems are structural. The new leader would likely also face difficulties in trying to fix today’s problems. I am afraid we will have to wait for the self-organizing economic system to find a solution for us. Perhaps innovations can bring us new ways of doing things that will eventually work around these difficulties. But, for the near term, higher levels of conflict because of resource shortages seem likely. By Gail Tverberg via Our Finite World

The author of Our Finite World is Gail Tverberg. She is a researcher focused on figuring out how energy limits and the economy are really interconnected, and what this means for our future. Her background is as a casualty actuary, working in insurance forecasting. Gail Tverberg, Charles Hall, Mario Giampietro, and Joseph Tainter in auditorium in Barcelona, Spain. They would later answer questions from students from 11 high schools in the area. Translation from Catalan to English was provided by headphone. Gail first became aware of oil shortages, and the impact they could have on insurance companies, back in the 1973 – 1974 period, when oil limits were first a problem. In 2005, she began reading books on the subject, including Jeremy Leggett’s The Empty Tank. Gail did further research about the situation, and wrote her first article about the potential impact on the property-casualty insurance industry in early 2006. In March 2007, Gail decided to research the issue of limits of a finite world on a full-time basis, leaving her career in insurance consulting. She began OurFiniteWorld.com in 2007, but temporarily changed her writing base to TheOilDrum.com between mid-2007 and 2010, where she was a writer and editor. Since late 2010, her blog posts have been published on OurFiniteWorld.com. These posts are widely republished under Gail’s Creative Commons license; many posts are translated into other languages and republished. Besides blog posts, Gail is the author of a number of academic papers. The most widely cited is, “Oil Supply Limits and the Continuing Financial Crisis.” Another academic paper of interest is, “An Oil Production Forecast for China Considering Economic Limits,” published in 2016. Section 2 of this paper discusses the possibility that the limit on oil extraction may be a financial limit: prices cannot rise high enough. A longer list of academic papers and papers for insurance audiences is given on the sidebar. Gail also speaks to many groups regarding her views on energy limits and the economy. She has spoken in many countries around the world, including Italy, Spain, China, and India. She has spoken to academic groups, actuarial groups, “Peak Oil” groups, and more general groups, such as religious groups and graduate students. In early 2015, she taught a course at China University of Petroleum in Beijing on “Energy and the Economy.” In 2017, she was one of the invited speakers at a European Commission workshop relating to “New Narratives of Energy and the Economy” in Brussels. In February 2021, she gave a Zoom lecture called Where Energy Modeling Goes Wrong, on behalf of the Uncomfortable Knowledge Hub. Gail’s work is different from that of other researchers in that she does not take widely-accepted views as a “given.” Instead she tries to figure out for herself precisely what is happening by looking at a wide range of data and literature, and by investigating leads offered by other researchers and by commenters on OurFiniteWorld.com. In a sense, her wide-ranging view is only possible because of the miracles of the internet and of second-hand books available through Amazon. One key to Gail’s independence is the fact that she does not take donations or accept advertising on her website. Another key to her independence is the fact that she is not part of the university system, and thus is not subject to the demands of “publish or perish.” Being separate from the university system also allows her to take a broader view of the subject, because “academic silos” are no longer a problem. Gail has an M. S. from the University of Illinois, Chicago, in Mathematics, and is a Fellow of the Casualty Actuarial Society. She is also a Member of the American Academy of Actuaries. Some of her early writing can be found under the name “Gail the Actuary,” a pen name used on articles published at The Oil Drum between 2007 and 2013. She has literally hundreds of articles on this site, OurFiniteWorld.com. Gail can be reached at GailTverberg at comcast dot net or at (407) 443-0505. Her twitter feed is @gailtheactuary.

|

Send this article to a friend:

|

|

|